How Electric Vehicles Could Affect State Transportation Budgets

Pew-supported study urges states to identify potential future shortfalls

Federal and state incentives, combined with changing consumer preferences, have helped to boost sales of electric vehicles (EVs) in the United States at a time of growing concerns about climate change. Although EVs only make up 1.3% of current vehicle registrations nationwide, sales grew by 57% year over year in the first half of 2023, reaching over 9% of all vehicle sales by the end of 2023, up from around 2% in 2020.

At this point, the EV transition is inevitable and necessary to limit the effects of a changing climate—the transportation sector is responsible for the largest share of greenhouse gases in the U.S. and a central focus of the Biden administration’s efforts to meet international targets for reducing emissions. But it will also present unique challenges to states, which traditionally rely on fuel tax revenues to fund expenses for state transportation infrastructure such as roads, highways, and bridges.

With these compounding changes in mind, state policymakers need to take a closer look at how the EV transition could affect their transportation budgets. Diminishing fuel tax revenue, combined with growing expenses for road maintenance and charging infrastructure will have a profound effect on how states are able to fund critical transportation infrastructure.

With support from The Pew Charitable Trusts, the Dynamic Sustainability Lab at Syracuse University recently examined the potential impact of the EV transition on state transportation revenues and expenditures. Because EV adoption rates and fuel tax revenue vary greatly by state, the impact to state budgets will also vary (see map). Still, each state will need to prepare for the unique budgetary challenges that this change will bring. The key findings from the white paper are summarized below.

Source: Dynamic Sustainability Lab, “The Emerging Highway and Roads Revenue Gap” (2024)

1. The EV transition will exacerbate existing fuel tax revenue declines and boost demand for infrastructure funding.

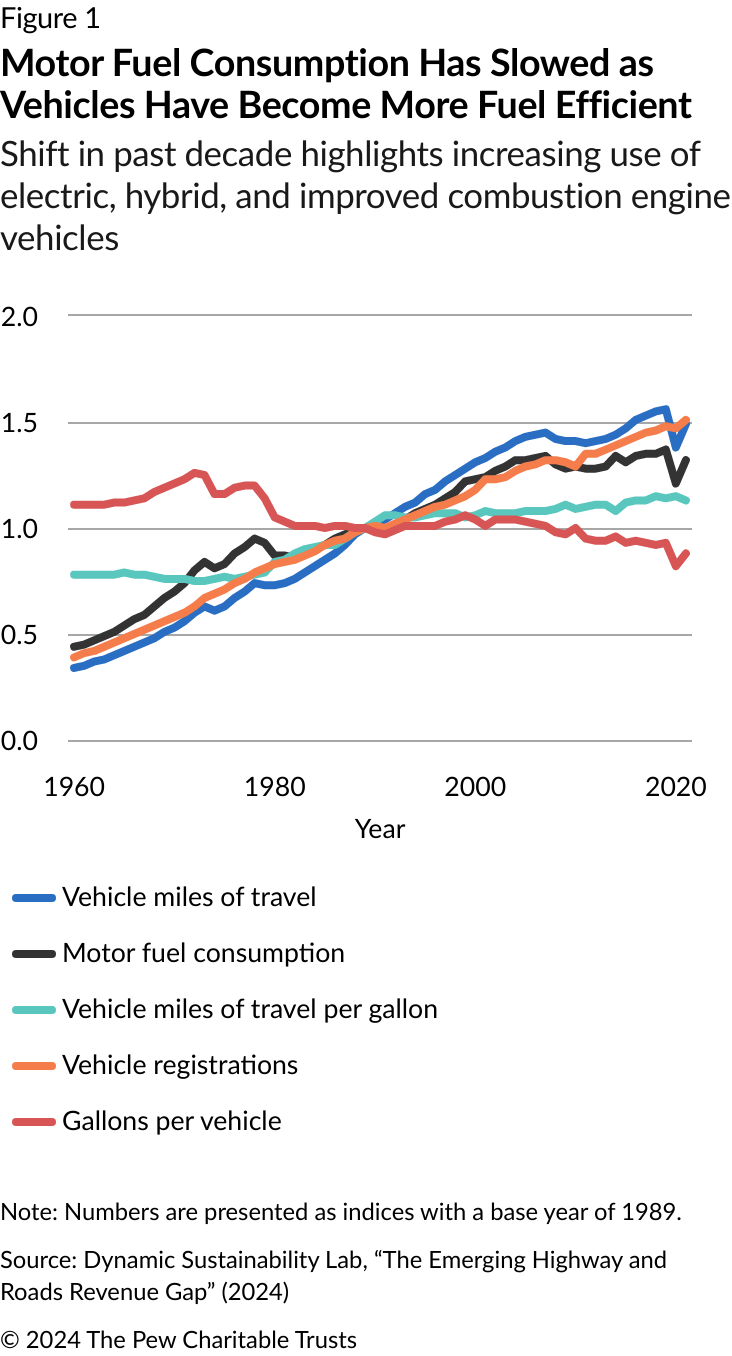

States fund initiatives to support their highways and roads in several ways, but the primary source is per gallon fuel excise taxes. In 2021, revenue from state and local motor fuel tax revenue exceeded $53 billion nationwide. However, as EVs become a greater share of total vehicle registrations and the demand for fuel slows, the lab’s white paper predicts that the revenue streams from these taxes will become less reliable. As seen in Figure 1, fuel consumption has already been slowing as new vehicles have become more fuel efficient.

Additionally, the federal Highway Trust Fund, which provides grants to states and local governments for maintaining highways and roads, faces its own challenges. In recent years, spending from the fund has exceeded revenues; in fact, the Congressional Budget Office estimates that it could be depleted by 2028 if spending increases at the rate of inflation and taxes remain the same.

These challenges come at a time when years of underinvestment in critical transportation infrastructure has already resulted in a large gap between needed maintenance and available funding for roads, bridges, and highways. Additionally, climate change is having noticeable effects on these infrastructure systems already because of the increase in more severe storms, altered precipitation patterns, and sea-level rise.

2. EVs could present long-term revenue challenges, beyond reduced fuel tax revenue.

Although the EV transition will undoubtedly primarily affect fuel tax revenues, the Sustainability Lab’s report highlights several other possible long-term revenue considerations. For example, if fewer people frequent gas stations and convenience stores, states could see some decreases in sales tax revenue—gas stations and convenience stores generated more than $200 billion in taxes nationwide in 2022.

Similarly, lottery sales could decrease if EVs lead to lower foot traffic in gas stations and convenience stores. In 2020, convenience stores accounted for 70% of all lottery sales in the U.S. These sales are an important source of revenue in many states; for example, in Delaware, lottery revenue is the state’s fifth largest revenue source. Although less significant, other considerations highlighted in the report include losses in sales tax revenue from EVs having lower maintenance costs and property tax losses if gas stations are sold or abandoned.

3. EVs will increase necessary transportation expenditures.

In addition to creating unique revenue challenges, the EV transition will also have expenditure implications. First and foremost, the Sustainability Lab white paper highlights that the weight of EVs—EVs weigh about 30% more than gas-powered vehicles— will increase maintenance costs for roads, highways, and bridges.

Additionally, states will need to install and maintain EV charging stations, upgrade utilities to support charging infrastructure, develop new revenue streams to offset fuel tax revenue losses, and manage abandoned underground storage tanks as gas stations decrease in number. All of these actions will put a strain on already stretched state transportation budgets.

4. States should model transportation budget shortfalls and plan for the future.

Because decreasing fuel tax revenues and increasing expenditures will create a budget gap, the Sustainability Lab recommends that states model their transportation budget shortfalls. This could include, for example, an analysis of how different EV adoption rates would reduce fuel tax revenues and increase expenditures. Only a handful of states—California, Michigan, Rhode Island, and New York—have modeled the budgetary impact of the EV transition.

The white paper also proposes several strategies that states can use to offset budget shortfalls, which are summarized in Table 1. Emerging strategies include imposing road user charges (also called distance-based user fees, vehicle-miles traveled taxes, or mileage-based user fees), which charge travelers based on how far they travel on a road or highway, instituting EV registration fees, or charging an electricity sales tax.

Table 1

The EV Transition Will Require States to Find New Ways to Fund Transportation Infrastructure

Emerging strategies can help counter budget shortfalls

Assessing the fiscal landscape

| Strategy | Description | Adopters | |

| Model surface transportation budget shortfalls | Most states have not modeled how EVs will impact revenues (primarily through decreases in fuel tax revenue) or expenditures, an important first step in identifying future budget shortfalls. |

|

|

| Quantify fuel tax revenues derived from out-of-state automobiles and truckers | Some policy strategies do not account for nonresident usage of state highways, roads, and bridges. Therefore, all states should quantify the current percentage of fuel tax revenues obtained from nonresident vehicles. Tennessee provides an example of why quantifying this variable is important; 30% to 40% of Tennessee’s fuel tax revenue comes from nonresident truckers and drivers. | ||

Revenue-raising options

| Strategy | Description | Trade-offs | Adopters |

| Road user charges (RUCs) |

|

|

These states are piloting projects or have implemented programs:

|

| EV annual registration fee |

|

|

Thirty-two states have some form of annual EV additional fees. |

| Increase existing fuel tax |

|

|

|

| Electricity sales tax |

|

|

|

| Dramatically expand tolling in states |

|

|

| Source: Dynamic Sustainability Lab, “The Emerging Highway and Roads Revenue Gap” (2024) |

Although the exact budgetary impact of EVs is unknown, they will continue to become more prevalent, which will force states to adapt to changing revenue sources and expenditures. And while there are drawbacks to all the emerging budget strategies to reduce shortfalls, the Sustainability Lab’s white paper highlights why it is important that states quantify and plan for the potential impacts of this ongoing transition.

Mollie Mills is a principal associate, Susan Banta is a project director, and Fatima Yousofi is a senior officer with The Pew Charitable Trusts’ state fiscal policy project.