Despite Risks, Thousands of Minnesotans Buy Homes Using ‘Contracts for Deed’

A review of the state’s land contract financing market

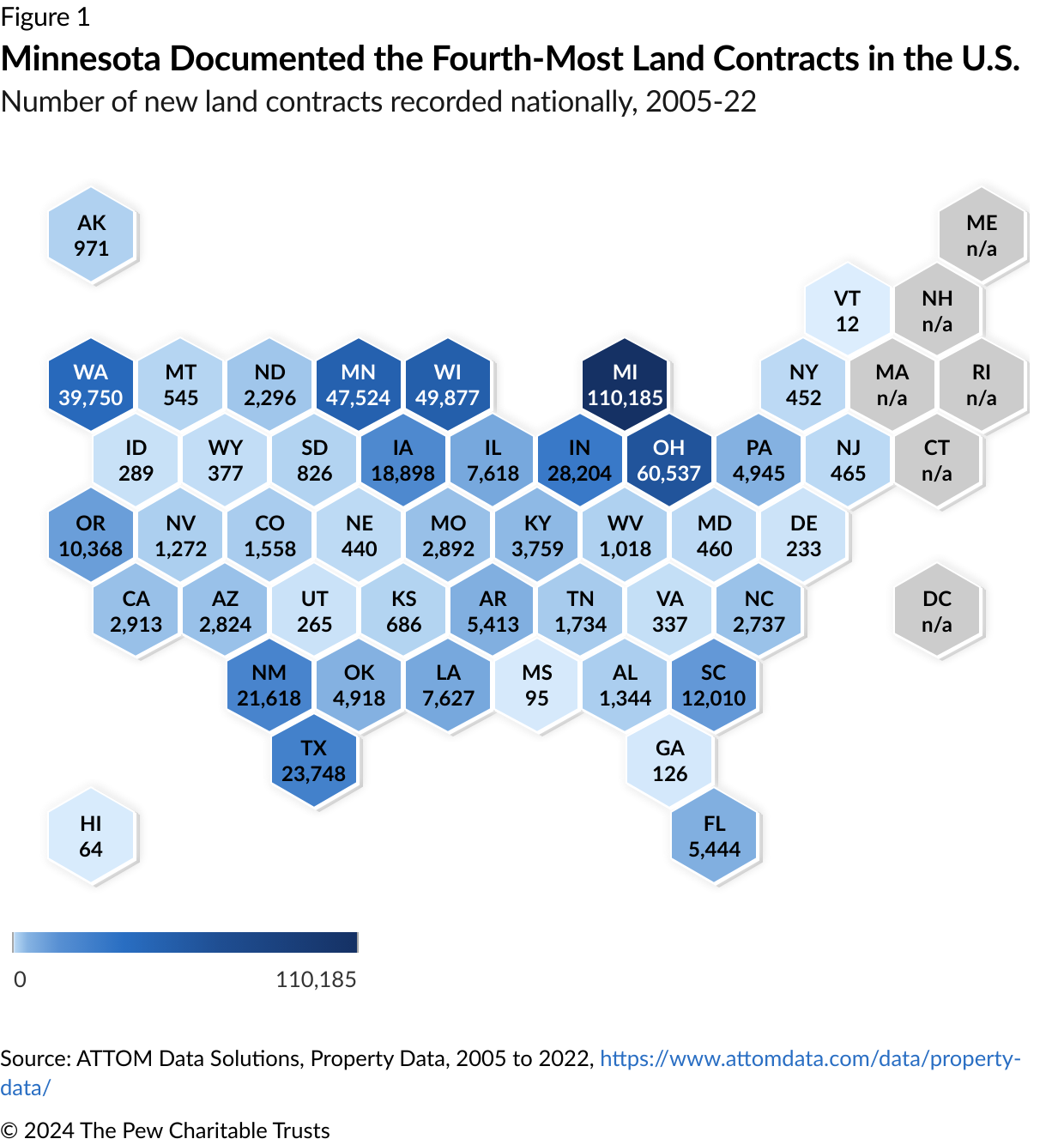

Editor’s note: This fact sheet was updated on June 13, 2024, to correct seven states' data in Figure 1.

Overview

Each year, thousands of Minnesota homebuyers turn to land contracts—commonly known in the state as “contracts for deed”—rather than mortgages to finance their purchases. But advocates and policymakers from both parties at the state and federal levels have raised concerns about these land contracts, particularly in light of recent reporting about harmful practices affecting Minnesota’s Somali-American community.1 And research by The Pew Charitable Trusts has found that, although many land contract buyers rate their experiences positively, contracts for deed are inherently riskier than mortgages and sometimes leave buyers worse off financially than before they entered into their arrangement.2

In Minnesota, policymakers are considering new legislation that would further protect contract for deed homebuyers.3 To help inform those policies, Pew analyzed real estate transaction data from 2005 to 2022 and identified several key features of the contract for deed market nationwide and in Minnesota specifically.

How contracts for deed work

In a contract for deed transaction, the seller extends credit directly to the homebuyer, without involving a third-party lender. The buyer then makes payments to the seller on an agreed schedule. However, unlike with a mortgage, land contract homebuyers obtain only equitable ownership of the property in tandem with the seller—rather than full sole ownership—until the final payment is made. This arrangement creates ambiguity that often leaves the home’s legal ownership and the buyer’s and seller’s responsibilities regarding home maintenance, property taxes, and other common expenses of homeownership unclear. Further, these contracts are not subject to a comprehensive national regulatory standard and instead are governed primarily by state laws. As a result, requirements and consumer protections for these arrangements vary widely throughout the country.

Minnesota—one of 21 states that have passed laws to govern land contracts—requires that some sellers provide buyers with a disclosure form at least five days before the execution of the contract.4 The disclosure ensures that the contracts are recorded with the local jurisdiction and specifies which party is responsible for various common expenses. However, Minnesota also allows a seller to cancel a buyer’s contract after 60 days of nonpayment, significantly faster than what a mortgage-borrower is entitled to through the state’s foreclosure processes.5

Minnesota’s contract for deed market from 2005 through 2022

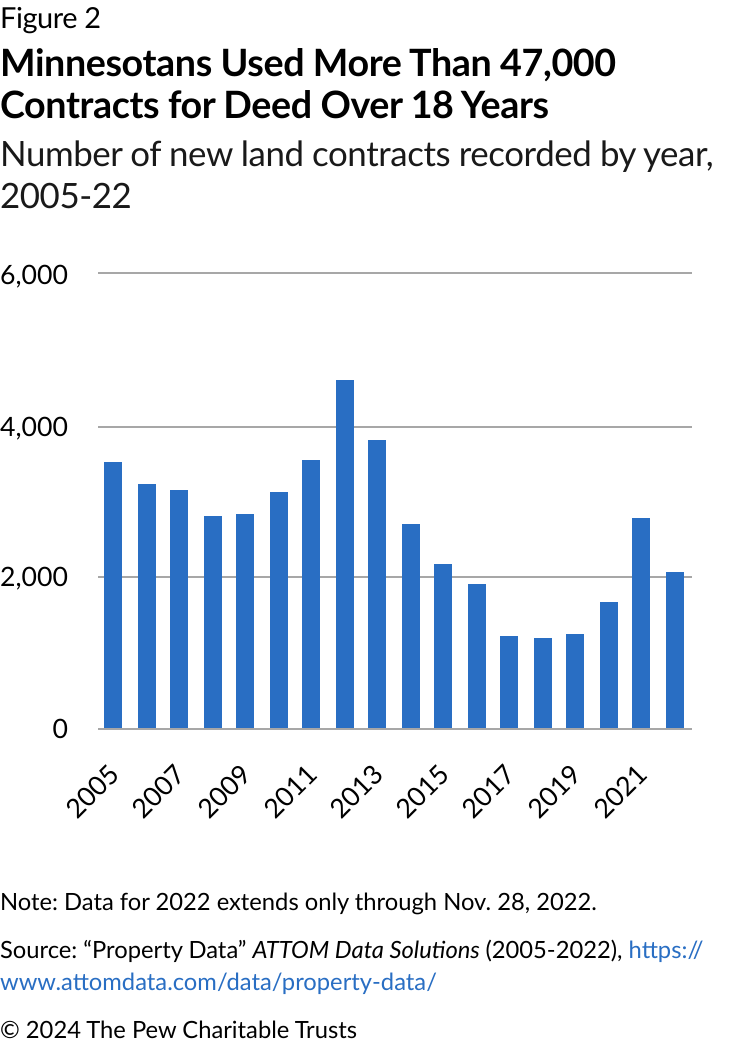

- Contracts for deed are common in Minnesota. County governments recorded 47,524 land contracts in the state—the fourth highest in the nation. (See Figure 1.) Contract for deed recordings peaked in Minnesota in 2012 (see Figure 2) and have generally tended to rise and fall in line with national trends.

- Contracts for deed are most common in urban areas. Hennepin County recorded 6,707 land contracts, the most in the state. St. Louis County (5,209), Olmsted County (2,776), and Ramsey County (1,964) also recorded a significant number of contracts.

- Contracts for deed are often used to purchase residential properties. About 3 in 4 Minnesota contracts for deed were used to purchase homes, with the rest used for agricultural or commercial properties.

- Contracts for deed are often used to purchase low-cost properties. The median value of a contract for deed in Minnesota was $140,000.

- Most contract for deed sellers are individuals. Just 18% of land contracts in Minnesota involved a corporate entity selling to an individual buyer, while nearly 63% involved one individual selling to another individual.

- Minnesota is the only state in the nation that requires buyers—rather than sellers—to record their contract for deed. Just 12 states require land contracts to be publicly recorded, and most place the responsibility for filing the paperwork on the seller. But in Minnesota, that responsibility falls to the buyer.

Endnotes

- J. Lussenhop and J. Peters, “After Seeing Controversial Contract-for-Deed Home Sales Affect Constituents, Minnesota Lawmakers Propose Reforms,” ProPublica, published Feb. 13, 2024, https://www.propublica.org/article/minnesota-lawmakers-propose-contract-for-deed-home-sales-reform; Tina Smith, U.S. Senator for Minnesota, “U.S. Senators Tina Smith, Cynthia Lummis Introduce Bipartisan Legislation to Protect Prospective Homebuyers From Predatory Financing Agreements,” news release, Feb. 1, 2024, https://www.smith.senate.gov/u-s-senators-tina-smith-cynthia-lummis-introduce-bipartisan-legislation-to-protect-prospective-homebuyers-from-predatory-financing-agreements/.

- The Pew Charitable Trusts, “Appendix B: Alternative Financing Survey Toplines,” (2023), https://www.pewtrusts.org/-/media/assets/2023/06/appendices-small-mortgages-are-too-hard-to-get.pdf; The Pew Charitable Trusts, “Senate Eyes Land Contract Risks, Opportunities,” published July 11, 2023, https://www.pewtrusts.org/en/research-and-analysis/speeches-and-testimony/2023/07/11/senate-eyes-land-contract-risks-opportunities.

- Minnesota Senate File 3489 (93rd Legislature 2023-2024), https://www.revisor.mn.gov/bills/text.php?number=SF3489&version=latest&session=ls93&session_year=2024&session_number=0.

- National Consumer Law Center, “Summary of State Land Contract Statutes” (2021), https://www.pewtrusts.org/en/research-and-analysis/white-papers/2022/02/less-than-half-of-states-have-laws-governing-land-contracts; Minnesota Standard Residential Purchase Agreement, https://eforms.com/images/2018/07/Minnesota-Standard-Purchase-Agreement.pdf.

- Minnesota Chapter 559 Section 559.21 Contract Termination, Notice, Service, Costs, Conditions (2023), https://www.revisor.mn.gov/statutes/cite/559.21.